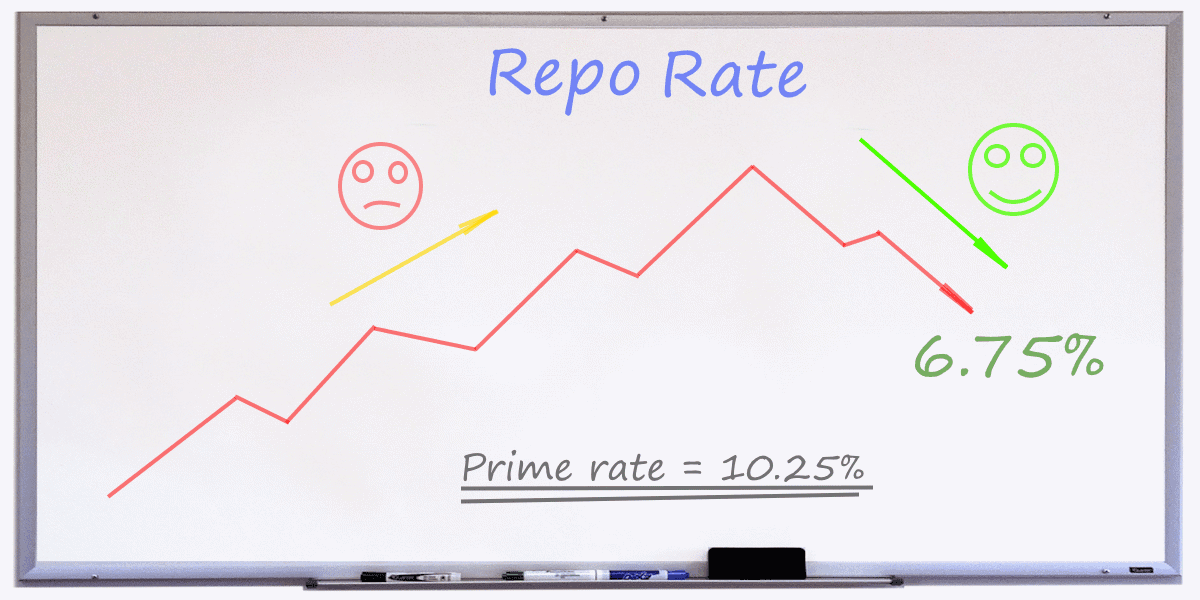

The South African Reserve Bank (SARB) closed the year on a positive note with a further 25-basis-point reduction to the repo rate, now at 6.75%, taking the prime lending rate to 10.25%. This marks the sixth rate cut since September 2024, and industry experts say the move strengthens momentum heading into 2026.

Affordability Relief Boosts Homeowners

Property leaders highlight that the cumulative impact of rate cuts is now significant.

Berry Everitt, CEO of Chas Everitt International, says the combination of lower rates and easing inflation means homeowners are experiencing meaningful relief—with someone holding a R1.6-million bond now paying at least R1,500 less per month than before the cutting cycle began. He urges homeowners to treat this as a strategic window rather than substitute spending money.

Lew Geffen Sotheby’s CEO Yael Geffen echoes this, adding that maintaining previous instalment levels can rapidly accelerate equity growth and long-term wealth creation. Stronger affordability, she says, could support a more stable market in 2026.

Rising Confidence and a Strengthened Buyer Pool

Optimism is spreading, with FIRZT Realty’s Stephen Whitcombe noting that lower repayments will make qualifying for home loans easier and improve overall consumer confidence—though he stresses job creation remains vital.

Data supports these trends. ooba Home Loans CEO Gavin Lomberg notes that home loan applications are up 7% quarter-on-quarter, with approval rates climbing to 83.9% and prequalified buyers achieving 91% approvals. He expects more first-time buyers to re-enter the market as rates soften.

Seeff Property Group’s Samuel Seeff believes momentum is returning but says further cuts in early 2026 could reinforce stability if inflation remains within target.

Industry Momentum Gains Speed

Across real estate brands, the sentiment is similar: affordability is improving, and buyers are re-emerging.

- Huizemark CEO Bryan Biehler says affordability gains mean families who paused plans can now act with renewed confidence.

- Rawson Property Group reports rising buyer engagement, with national sales manager Craig Mott saying the latest cut will accelerate this trend.

- Rawson Finance’s Leonard Kondowe emphasises that banks’ willingness to lend, combined with softer rates, creates an ideal environment for financially prepared buyers.

- Investor activity is also trending upward, especially in sectional title and lifestyle-driven markets.

Leapfrog’s Silvana dos Reis Marques notes that preparedness is crucial: buyers who have their documents and pre-approvals ready will be best positioned to seize opportunities in areas like Pretoria East and Irene, where sellers are becoming more realistic on pricing.

Cape Town Leads Regional Strength

Cape Town is already showing strong activity.

Quay 1 International Realty’s CEO Ryan Greeff says a psychological shift is underway, with buyers planning more confidently and property reclaiming importance in financial planning. With tight supply and growing confidence, price strengthening is expected heading into summer.

Strategic Investing Still Key

Despite rising optimism, experts urge caution.

Tyson Properties CEO Chris Tyson advises buyers to be disciplined, consolidating small savings to ensure comfortable bond repayments. He suggests additional cuts may materialise by mid-2026 if inflation trends near 3%, but warns buyers not to overextend.

Major Brands Anticipate Renewed Growth

Jawitz Properties CEO Herschel Jawitz and RE/MAX Southern Africa’s Adrian Goslett both welcome the rate cut. They believe it provides meaningful relief, supports lending competitiveness, and could mark the beginning of renewed market growth.

Outlook for 2026

Facing the new year, analysts agree the fundamentals are improving:

- Buyer confidence is rising

- Affordability is strengthening

- Banks are eager to lend

- Market sentiment is shifting positively

If inflation remains stable and momentum continues, 2026 could usher in a more active, balanced, and sustainable phase for South Africa’s residential property market.

Read the article