Thanks to Property Professional and Property24

https://www.property24.com/articles/market-reacts-as-repo-rate-drops-to-7/32697

Here’s what some of SA’s property industry experts have to say about the repo rate, its impact on homeowners and the property market.

Repo rate cut expected to stimulate housing market

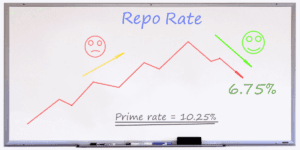

The Monetary Policy Committee’s decision to reduce the repo rate by a further 25bps is extremely positive news for the residential property market, providing increased confidence and incentive for aspirant home buyers and some relief for those with existing mortgages, says Dr Andrew Golding, chief executive of the With the SA Reserve Bank repo rate reducing to 7.0%, the prime lending rate drops to 10.5%.

As the recovery in first-time buyer demand has stalled, at least temporarily, at 46.4% of applications during H1 2025 this latest interest rate cut – together with last month’s reduction, coupled with a reduced fuel price and the still subdued consumer inflation rate, is expected to support first-time buyer demand in the months ahead as this sector of the market is extremely sensitive to interest rate cuts. Importantly, the reduced interest rate will also help boost market sentiment in general.

Rate cut a welcome boost for consumers and homeownership

Today’s announcement that the Reserve Bank has decided to cut the repo rate by another 25bps to 7.00% (from 7.25%), and the prime rate to 10.50% (from 10.75% ) is welcome news for the economy and property market, says Samuel Seeff, chairman of the This is the third interest rate cut this year (fifth since September last year). Seeff says it is the correct decision given that inflation (at 3% for May) is below the Bank’s target range, and the currency has been stable, trading at times below R18/USD.

While this cut brings welcome relief for consumers by reducing borrowing costs and putting more money back into their pockets to spend in the economy, Seeff says it is still not enough. More needs to be done to really give the economy the rocket boost that it needs.

Nonetheless, the rate cut will make home loans will more affordable and property buyers will find it slightly easier to qualify, thus opening more doors to homeownership. The total rate cuts since September means that the interest rate will now be 1.25% lower compared to last year. The repayment on a bond of R1 million (over 20-years) will therefore now be reduced by around R853 per month.

We would therefore certainly encourage buyers to take advantage of the opportunities in the market, Seeff says further. Higher demand and improved house price appreciation at around 3.7% nationally (topping inflation for the first time in two years) also provides incentive for sellers, especially since many areas are in need of more property listings.

As a result of the 25bps rate cut, mortgage repayments will reduce by:

R750 000 bond | from R7,614 to R7,488 | saving R126 |

R900 000 bond | from R9,137 to R8,985 | saving R152 |

R1 000 000 bond | from R10,152 to R9,984 | saving R168 |

R1 500 000 bond | from R15,228 to R14,976 | saving R252 |

R2 000 000 bond | from R20,305 to R19,968 | saving R337 |

R2 500 000 bond | from R25,381 to R24,960 | saving R421 |

R3 000 000 bond | from R30,457 to R29,951 | saving R506 |

R5 000 000 bond | from R50,761 to R49,919 – | saving R84 |

(Based on a 20-year repayment period at the prime rate)

.

Tyson welcomes interest rate drop but advises caution

Today’s decision by the Reserve Bank’s Monetary Policy Committee to drop the repo rate by 0.25 basis points to 7% will give South Africans good reason to be optimistic despite the gathering storm clouds ahead of tomorrow’s expected imposition of tariffs by American President Donald Trump.

Tyson Properties CEO, Chris Tyson, welcomed the drop in the repo rate amidst the lingering uncertainty about the actual impact of ongoing geopolitical conflict and tensions on the local economy. It is the first since May this year.

“There is always the risk that we remain so focussed on the ongoing negatives that we fail to see the many positives. We should not forget that the current interest rate environment continues to offer both those entering the property market and those who are repaying loans on properties the best borrowing conditions in years,” he said.

Tyson Properties Director, Francois du Toit, agrees that this small interest rate cut will not only help people to feel more positive but to keep the property market on the path to recovery: “Whilst the Cape Town market continues to boom, the KwaZulu-Natal market is holding firm. Johannesburg is seeing a slow but consistent recovery.”

Taking a longer-term view, he notes that households across the world are likely to remain under pressure. He says the new ‘worldwide norm’ is for people to be more mindful of their budgets.

Although the Reserve Bank has held back on interest rate decreases since May, its latest move, which brings the prime lending rate down to 10.5% will put only a small amount back into the pockets of cash strapped households. Because this is likely to mark the end of the rate cut cycle, Tyson believes it is now up to homeowners to tighten their purse strings in order to plug budget leaks and bring disposable income back to acceptable levels.

Greg Dart, director of High Street Auction Co says the decision by the Reserve Bank Monetary Policy Committee to cut the repo rate by an expected 25-basis points is to be welcomed. Since September last year, the Monetary Policy Committee has remained cautious, keeping a strong hold on borrowings in light of ongoing geopolitical tensions and economic uncertainty. This latest move will inject some positivity into the economy.

However, one has to accept that global economic turbulence will continue. Right now, the only certainty is uncertainty and investors in the commercial and industrial markets have already factored in much of the turbulence when considering investments. The reality is that no-one really knows the exact impact of the imposition of tariffs by one of the country’s largest trade partners.

Just as tariffs might lead to increased job losses and fully realise predictions that economic growth will be below the 1% mark this year, these be the so-called last straw that sparks government and even the private sector to re-ignite long overdue industrialisation and growth in manufacturing.

Interest rate cut or no interest rate cut, the ongoing uncertainty is likely to continue to push real estate into a difficult patch. However, this creates opportunities for serious investors to take up opportunities. In effect, this is likely to create a price maker rather than a price taker market which facilitates price discovery and liquidity through auction.

It would be realistic to expect more businesses to resort to business rescue or restructuring. This increases the need to liberate liquidity and the need for us to partner with both businesses and business rescue practitioners to navigate this stressful and challenging process confidence.

“We therefore believe that, in the current climate, the auction platform will continue to be an important lifeline both for companies that are undergoing restructuring and investors who are positioning themselves for future growth,” he says.

Craig Mott, national sales manager for the Rawson Property Group, described the rate cut as a “welcome move for homeowners, buyers, and investors navigating a challenging economic landscape.” He acknowledged it might not be a major cut, but “in today’s market, even a small reduction helps – and it boosts confidence.” Mott, while cautious about global trade tensions and local energy risks, believes the cut creates a better window of opportunity for first-time buyers and encourages realistic pricing for sellers.

Herschel Jawitz, CEO of Jawitz Properties, stated that the 25-basis point cut will “continue supporting the slow recovery in the residential property market, both from an affordability and consumer confidence point of view.” He highlighted that the cumulative 1.25% reduction since the cycle began translates to an R840 monthly saving on a R1 million home loan, with the potential to significantly reduce loan periods and total repayments if homeowners maintain current payment levels. Jawitz believes this will sustain the increase in demand, eventually firming up property prices.

Ryan Greeff, CEO of Quay 1 International Realty, expressed pleasure at the SARB’s “proactive step,” particularly for the Cape Town market, where affordability and confidence are highly sensitive to rate adjustments. He anticipates the rate cut will provide a “perfect window for many aspiring homeowners to enter the Cape Town market,” and noted Quay 1’s strong momentum with over R1.4 billion in closed deals in H1 2025. Greeff highlighted the “psychological shift” occurring, with buyers beginning to plan for the future again and property returning as a central conversation in financial planning.

Rhys Dyer, CEO of the ooba Group, believes this second consecutive 25-basis point cut will significantly support homebuyers. He highlighted the tangible savings: “At the current

prime lending rate of 10.50%, the monthly repayment on a home priced at our Q2’25 average approved bond size of R1,455,712 equates to R14,534 over 20 years – down from R15,776 just a year ago. Savings like these add up to almost R15,000 extra in a homeowner’s pocket over the course of a year.” Dyer pointed to an 11% year-on-year increase in home loan applications in Q2’25, reflecting improved affordability and growing buyer confidence.

Bradd Bendall, BetterBond national head of sales, agrees, noting that “The housing market, which has already shown remarkable signs of recovery in recent months. BetterBond’s July data shows that bond applications rose by 7.4% for the 12 months to May 2025, with home loans granted up by an impressive 13.6%.

These volumes point to renewed buyer confidence and a more stable market environment that should encourage more aspirant first-time buyers to enter the property market.”

Adrian Goslett, regional director and CEO of RE/MAX Southern Africa, viewed the MPC’s announcement as a “welcome step towards reinvigorating economic activity and restoring consumer confidence.” He expects this cut to “serve as a much-needed catalyst for transaction volumes, particularly in the affordable and mid-market sectors.” Goslett noted the market’s continued buoyancy, with RE/MAX SA reporting sales figures up 12.5% and total units sold up 6.5% compared to last year.

However, Yael Geffen, CEO of Lew Geffen Sotheby’s International Realty, offered a different critical perspective. While acknowledging the short-term relief, she expressed concern about the broader economic context. “We’re on the precipice of an economic disaster, and while this rate cut will help for now, it might come back to bite us in the long term.” Geffen pointed to record unemployment, soaring household costs, and high debt servicing. She was particularly scathing about the timing, contrasting it with the US Federal Reserve’s decision not to cut rates amidst economic growth. Despite her economic concerns, Geffen reiterated property’s role as a safe-haven investment, noting, “Real estate will always be a safe-haven investment.”

The market has responded positively throughout 2025, even amidst global trade policy volatility, leading to increased demand and improved house price appreciation. While not a boom, the South African property market appears to be quietly strengthening, demonstrating resilience and a return to strategic, long-term thinking among buyers and homeowners. The journey ahead for the property sector, though still shaped by global and local pressures, appears to be one of cautious but steady recovery.